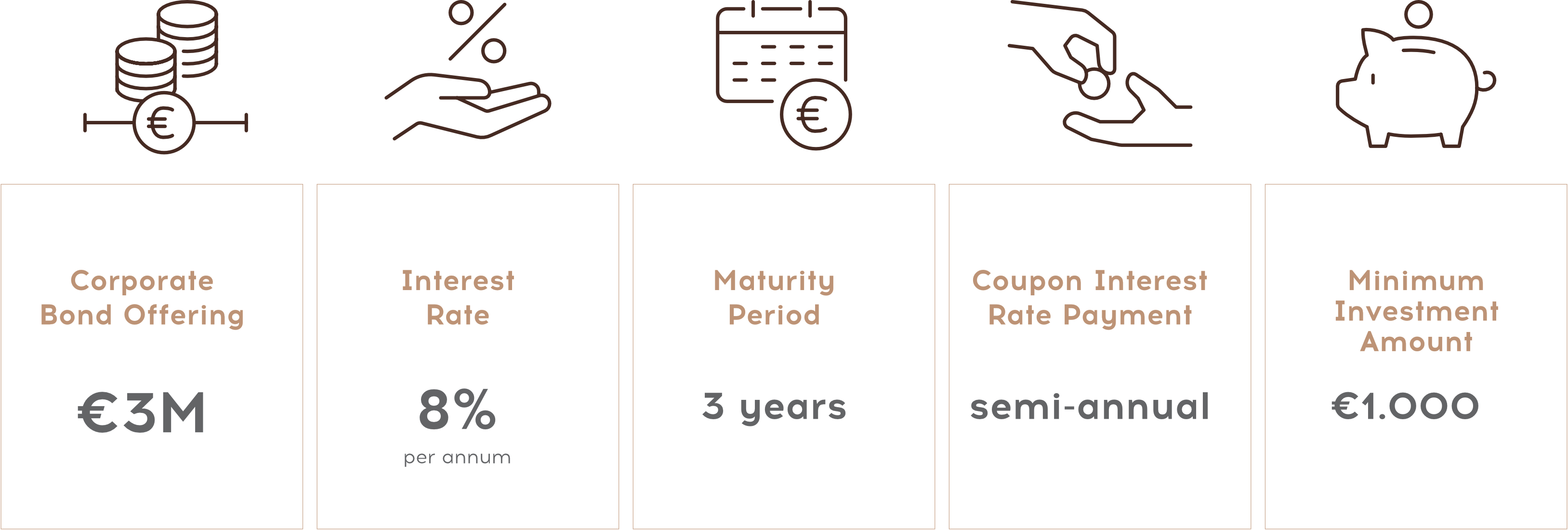

We are issuing €3M in corporate bonds to finance our expansion into Germany, Austria, Czechia, Slovakia, Hungary, Croatia and Slovenia.

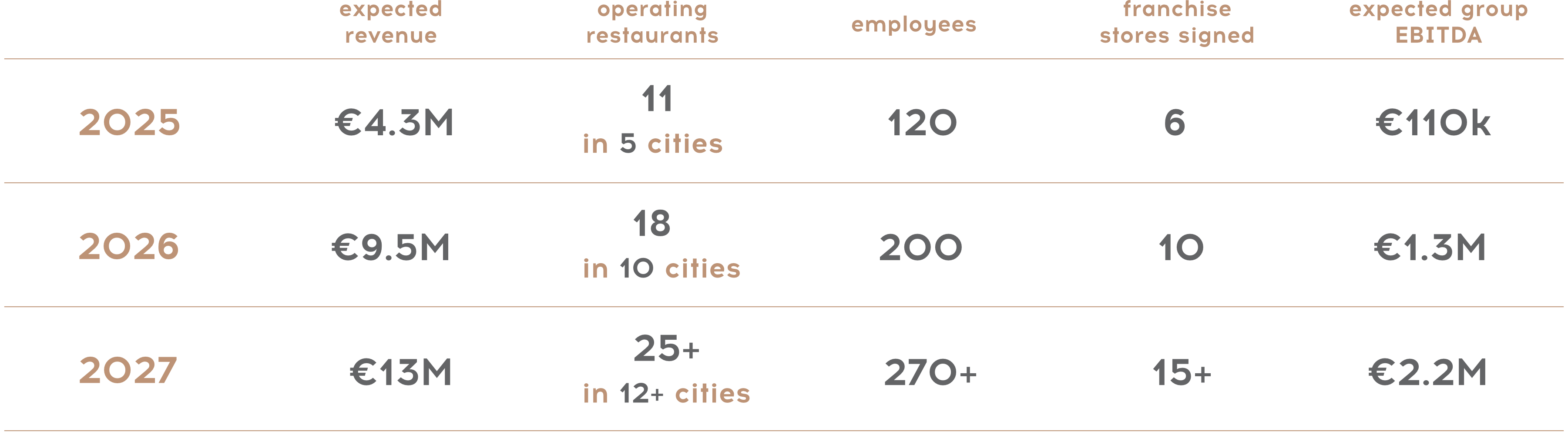

As of end-2024, Koykan has successfully raised €1.2M in equity financing (Q1 2023), upgraded two existing stores, launched two new franchise-compliant stores, and is currently building six corporate stores set to open in Q2-Q4 of 2025. The company has also secured several new locations for stores across Europe and signed an area development franchise agreements for Czechia and Slovakia. Koykan’s expansion plan aims to grow sales from €4.3M to €13M over the next 36 months, with a focus on both corporate-owned and franchise-operated stores in seven key countries.