Interested investors are kindly asked to complete the subscription form (download the form) and send it via email to bonds@koykan.com

💼 Koykan bonds – invest in the growth that is happening

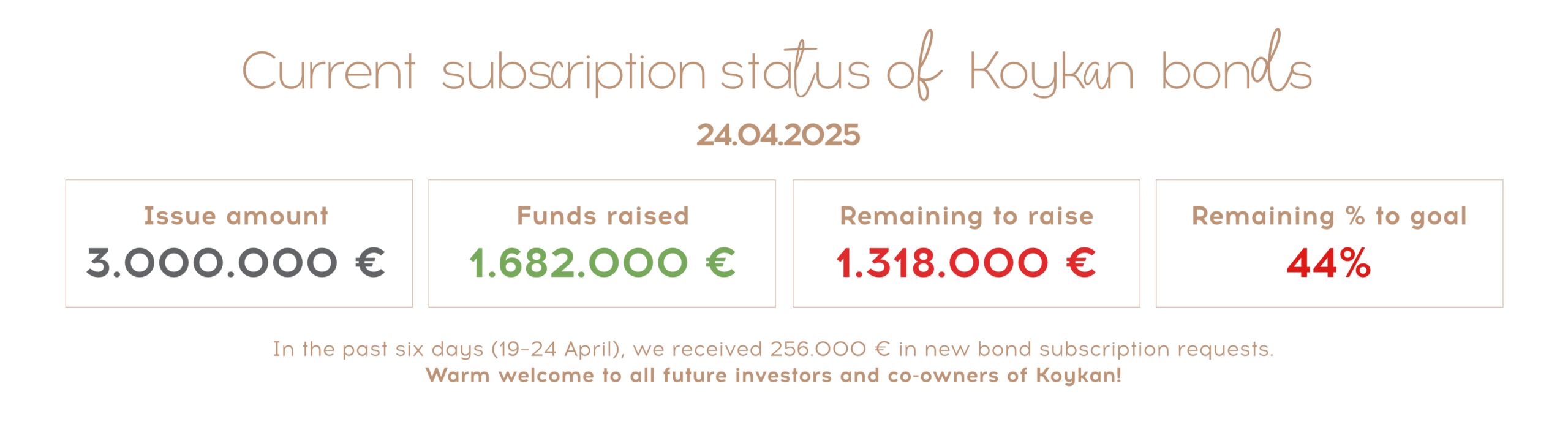

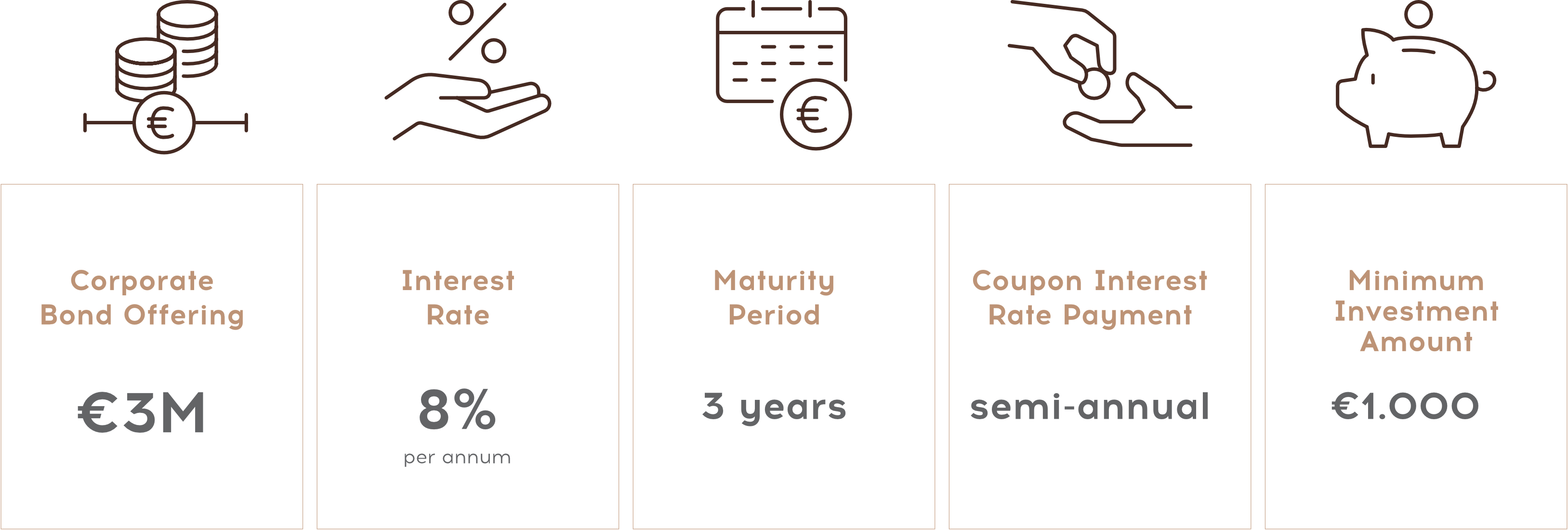

Koykan issues corporate bonds in the total amount of €3,000,000 with an annual yield of 8% and a maturity of 3 years.

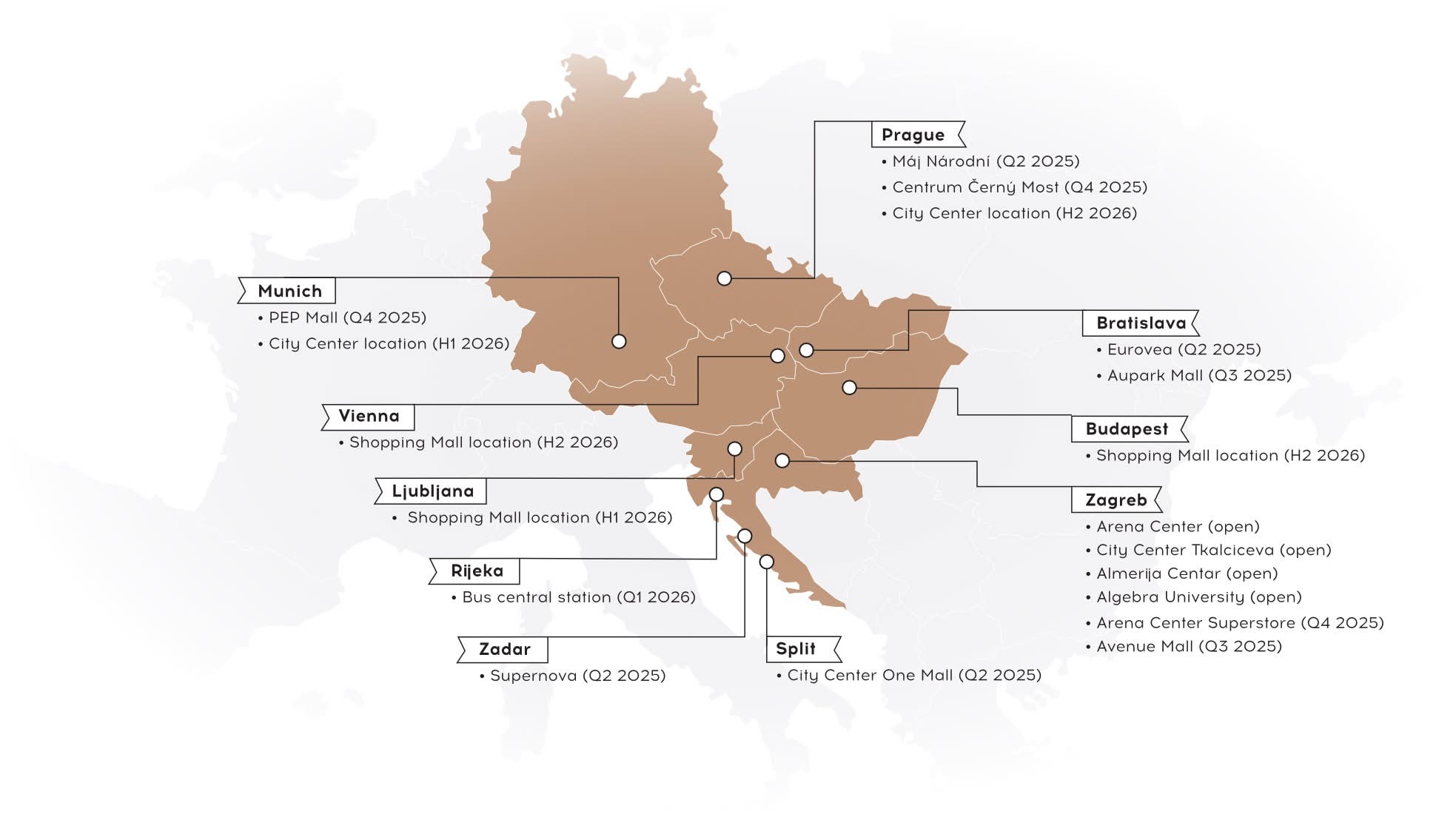

We are opening 15 new restaurants by the end of 2026 in Germany, Austria, Czech Republic, Slovakia, Hungary, Slovenia and Croatia.

📌 Key Bond Information:

- Issue amount: €3,000,000

- Interest rate: 8% annually

- Maturity period: 3 years

- Coupon interest payment: semi-annually

- Principal repayment: lump sum at maturity

- Bond types: standard and convertible

- Minimum investment standard: €1.000

- Minimum investment convertible: €50.000

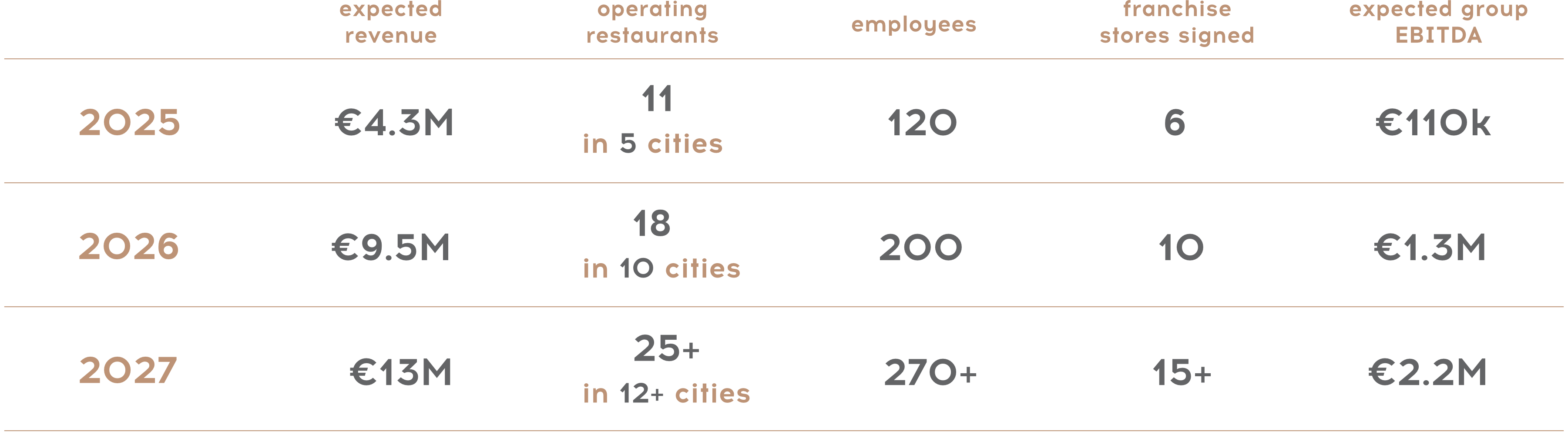

📌 Key Business Information:

- Number of locations: 15 restaurants by the end of 2026 in Germany, Austria, Czech Republic, Slovakia, Hungary, Slovenia and Croatia

- Average CAPEX per location: €250,000

- Return on investment per location: 18–24 months

- Revenue per location: €750,000 – €1,500,000 annually

- Target annual revenue by 2027: €13 million

- Target annual revenue by 2035: €100 million

🔎 Why Koykan?

Koykan is a street food restaurant chain with a proven business model, present in multiple countries, with active franchise partners and ongoing fit-out projects. Our growth is not theoretical – it’s happening now, on the ground. Investing in Koykan means entering a system that measures, delivers, and generates returns. Learn more about Koykan in the attached presentation and financial prospectus.

📈 What Are We Financing?

With the capital raised, Koykan will finance the expansion of its operational network in 7 countries across the region, including new franchise and own locations. This strengthens our market position and scales a system with high returns and above-average operational efficiency.

🔄 Convertible Bonds – An Opportunity for Ownership

The bonds include an option for conversion into equity under clearly defined conditions (details in the Q&A). This is a unique opportunity to become a co-owner of a modern Croatian entrepreneurial story that is growing regionally and globally – without compromising on quality or control.

🧾 What’s Next?

Interested investors are kindly asked to complete the subscription form (download the form) and send it via email to bonds@koykan.com

Once the subscription book is closed, a payment invitation will be sent.

The bonds will be registered with the CSD (Central Depository & Clearing Company), and all investors will receive official confirmation of subscription and account status. If you don’t yet have a CSD account, one will be opened automatically on your behalf.